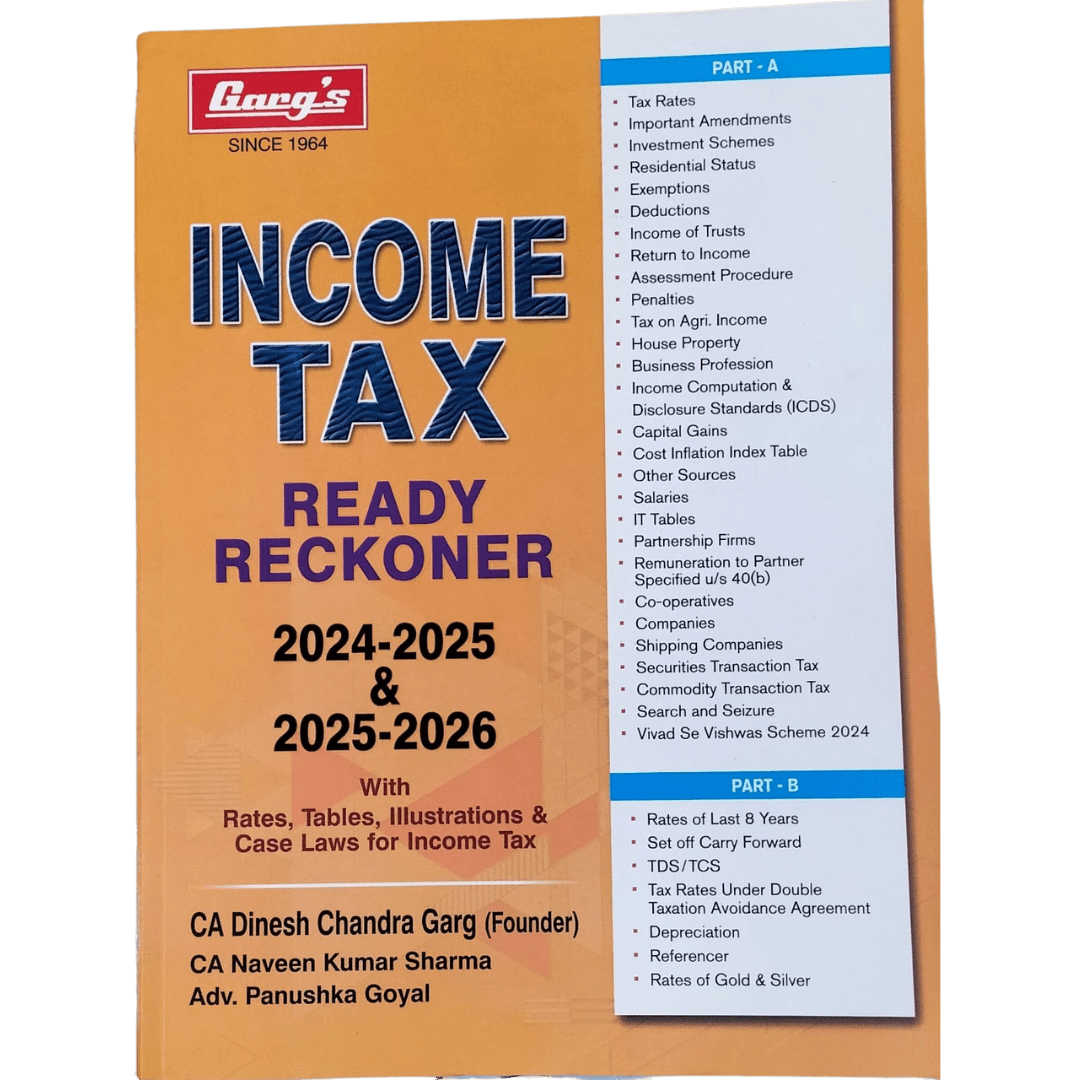

Gargs Income Tax Ready Reckoner Assessment Year 2024-2025

Contents

Part – A

- Tax Rates

- Important Amendments

- Investment Schemes

- Residential Status

- Exemptions

- Deductions

- Income of Trusts

- Return to Income

- Assessment Procedure

- Penalties

- Tax on Agri. Income

- House Property

- Business Profession

- Income Computation & Disclosure Standards (ICDS)

- Capital Gains

- Cost Inflation Index Table

- Other Sources

-

Salaries

-

IT Tables

- Partnership Firms

-

Remuneration to Partner Specified u/s 40(b)

-

Co-operatives

-

Companies

-

Shipping Companies

-

Securities Transaction Tax

-

Commodity Transaction Tax

-

Search and Seizure

-

Vivad Se Vishwas Scheme 2024

Part – B

- Rates of Last 8 Years

- Set off Carry Forward

- TDS/TCS

- Tax Rates Under Double Taxation Avoidance Agreement

- Depreciation

- Referencer

- Rates of Gold & Silver

Reviews

There are no reviews yet.