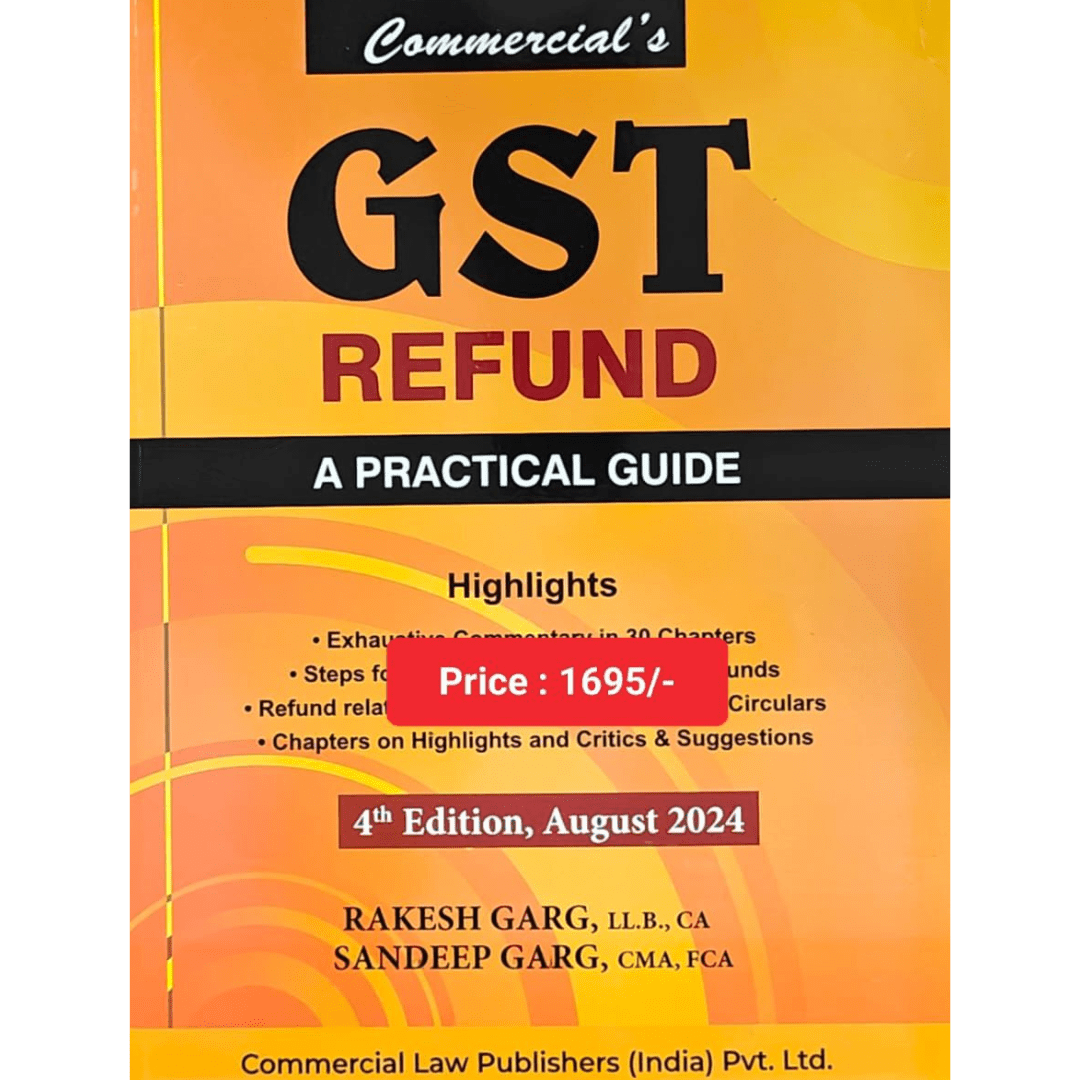

Contents

Part – A – Guide

A-I Terminology

A-2 Refund – Grounds & Mechanism

A-3 Refund – Time Limit

A-4 Export of goods with payment of GST

A-5 Export of services with payment of GST

A-6 Export against Bond/LUT

A-7 Goods sent out of India without supply

A-8 Supplies to SEZ-with payment of tax

A-9 Supplies to SEZ against LUT

A-l0 Deemed Export

A-11 Inverted Duty

A-12 Compensation Cess

A-13 Consequence of Order or Judgment

A-14 Change of place of supply

A-15 Electronic cash ledger

A-16 Canteen Store Department

A-17 U.N., Embassies and other specified Organisations

A-18 International Tourist

A-19 Seva Bhoj Yojna

A-20 Excess payment of tax

A-21 Any other ground

A-22 Acknowledgement

A-23 Withdrawal of Refund Application

A-24 Grant of Provisional Refund

A-25 Withhold the Refund

A-26 Processing & Disposal of Refund

A-27 Entries in Electronic Ledgers

A-28 Interest on Delayed Refund

A-29 Erroneous Refund

Part – B – Provisions

B-1 GST Refunds Related Sections

B-2 GST Refunds Related Rules

B-3 GST Refunds Related Forms

B-4 Refund related important Circulars

Part – C – Critics/ Suggestions

C GST Refund – Critics & Suggestions

Reviews

There are no reviews yet.